A calm, plain-English guide to Islamic home purchase plans in the UK, covering types, costs, eligibility, steps, and practical tips for confident, halal homebuying.

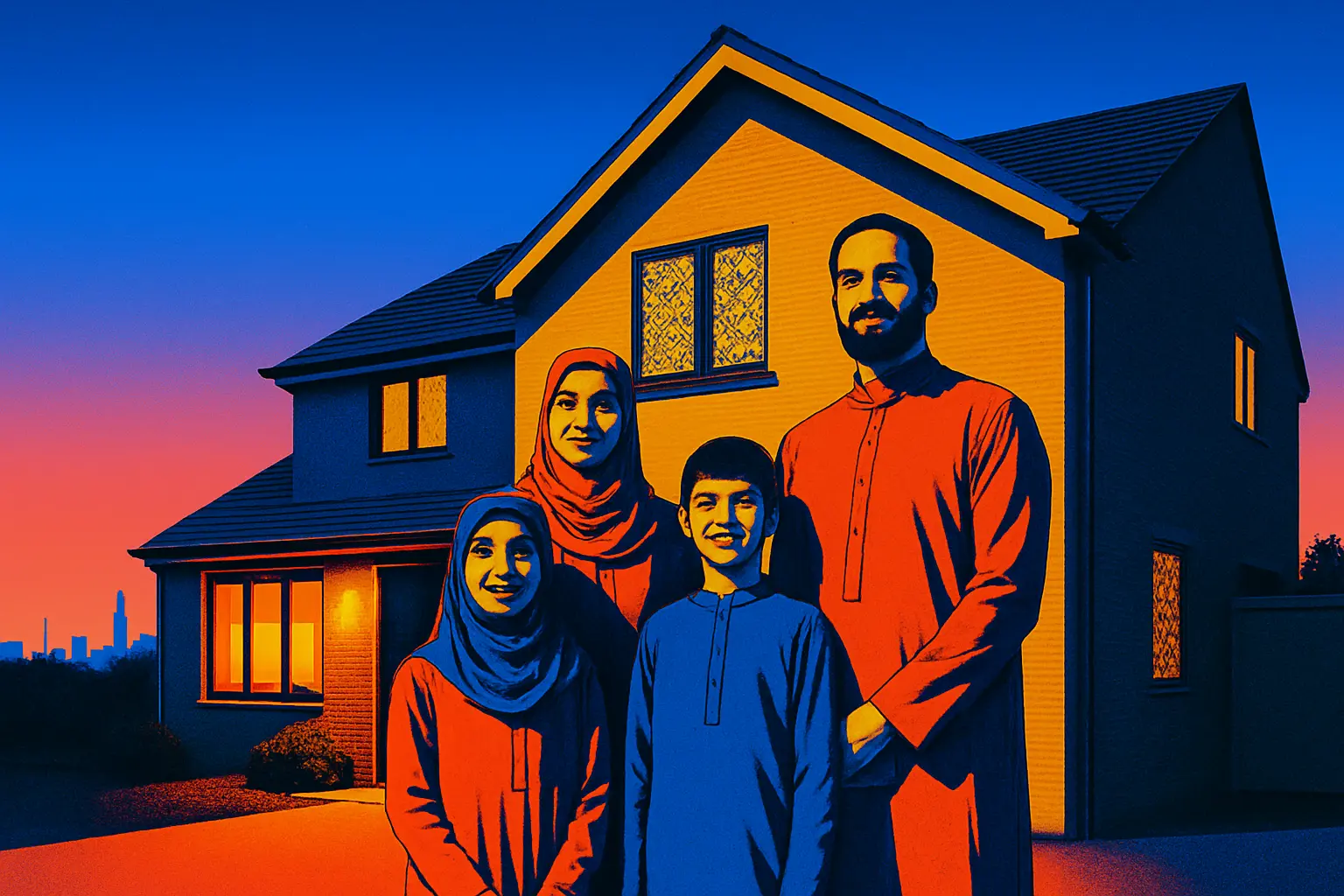

Buying a UK home the halal way

Owning a home matters, and doing it in a way that aligns with your faith matters too. Islamic home purchase plans in the UK are designed to help you buy a property without paying or receiving interest. Instead of debt with interest, these plans use structures like co-ownership, leasing, or a fixed profit. The aim is to keep things fair, transparent, and rooted in real assets.

In Great Britain, Sharia-compliant home finance is regulated in the same way as conventional mortgages, giving you the same consumer protections. Banks and building societies offering these plans must treat you fairly, explain the costs clearly, and assess affordability. You do not have to be Muslim to apply. Many people choose these products because they value ethical finance principles and clarity around how payments are calculated.

The most common option here is a co-ownership model called diminishing Musharaka. You and the bank buy the home together, you pay rent on the bank’s share, and you gradually buy that share until the property is entirely yours. Other routes include Ijara, where the bank owns the property and leases it to you with a purchase at the end, and Murabaha, where the bank buys the home and resells it to you at an agreed profit, repaid in instalments.

Do expect a higher deposit than some conventional deals. Many providers require at least 20 percent, sometimes more, reflecting the asset-based nature of the finance. You will also cover the standard homeowner costs like surveys, conveyancing, insurance, maintenance, and Stamp Duty Land Tax where applicable. Leading UK providers include specialist Islamic banks and a number of mainstream institutions that have built halal propositions to serve a wide range of customers. Some also support shared ownership style solutions that can lower the initial outlay.

Clear structure, real assets, and FCA regulation - Islamic HPPs can offer a reassuring path to ownership without interest.

If you are planning your first home or considering a refinance to move onto a halal plan, this guide walks through the options, costs, and steps so you can move forward with confidence.

Who this guide will help most

If you are a UK resident who wants to buy, remortgage, or refinance in a way that avoids interest, this is for you. It is also useful if you value ethical finance and prefer payments linked to a real asset rather than debt with interest. First-time buyers, growing families, and movers looking to align finances with faith will find practical direction here. Landlords exploring buy-to-let style halal solutions and UK expats considering a property back home may also benefit. The focus is on clarity, affordability, and suitability so you can choose a plan that genuinely fits your circumstances.

Your halal home finance options

- Diminishing Musharaka - co-ownership where you buy out the bank’s share over time and pay rent on their share until full ownership transfers.

- Ijara - the bank buys the property and leases it to you with fixed monthly payments, with ownership transferring at the end of the term.

- Murabaha - the bank purchases the home and resells it to you at an agreed profit, which you repay in instalments, typically with ownership from day one.

- Sharia-compliant shared ownership - you buy a defined share, pay rent on the remainder interest-free, and can staircase your ownership over time.

- Halal refinancing - switch an existing conventional mortgage to a Sharia-compliant plan, subject to affordability and legal checks.

Costs, impact and practical risks

| What | Typical range | Why it matters | Risk or impact |

|---|---|---|---|

| Deposit | 20% to 35% of price | Higher upfront savings commonly required | Affordability pressure and longer saving period |

| Monthly rent or payments | Provider set, sometimes benchmark-linked | Covers use of bank’s share or agreed profit | Payments can rise if benchmark or rent resets apply |

| Legal and conveyancing | £1,000 to £2,500+ | Specialist work for HPP documents | More complex documentation may add time |

| Valuation and surveys | £300 to £1,200+ | Confirms property condition and value | Unexpected repairs could affect suitability |

| Buildings insurance | £150 to £400+ yearly | Usually mandatory under plan terms | Non-compliance risks breach of contract |

| Stamp Duty Land Tax | Standard SDLT rules | Normal purchase costs still apply | Budget impact, especially above thresholds |

| Early exit or variations | Provider specific | Changes may trigger admin or legal fees | Reduced flexibility on short-term moves |

Eligibility and what providers look for

Providers assess affordability in a similar way to conventional lenders, but with documents tailored to Islamic structures. Expect checks on income, outgoings, credit history, and overall financial stability. A higher deposit is common, often 20 percent or more, though some providers will go up to 80 percent loan-to-value on certain property values. The property will need to be suitable security, usually standard construction and in a good state of repair. New-builds, ex-local authority, or unusual properties may be considered on a case-by-case basis.

Residency status matters. Many banks serve UK residents, and some extend to UK expats and international applicants subject to enhanced checks. If you are switching from a conventional mortgage, the provider will want to see that early repayment or redemption is achievable and that the new plan is affordable after fees. Buildings insurance is generally required throughout, and you will usually be responsible for maintenance costs even if the bank retains a share. If you need help comparing options or accessing specialist lenders, Kandoo can connect you to regulated partners who understand halal home finance.

Step-by-step to a halal purchase

- Check your budget and deposit target realistically.

- Compare HPP types and shortlist suitable providers.

- Get an Agreement in Principle before house hunting.

- Instruct a conveyancer experienced with Islamic plans.

- Complete valuation, surveys, and property checks.

- Finalise terms, documents, and rental or profit schedule.

- Exchange contracts and complete with clear funds.

- Move in, maintain insurance, and track staircasing.

Key advantages and trade-offs

| Factor | Pros | Cons |

|---|---|---|

| Faith alignment | Avoids interest, asset-based structures | Fewer providers than conventional market |

| Payment clarity | Transparent rent or profit schedule | Can be benchmark-linked, so may change |

| Path to ownership | Clear staircasing to full title | Early exit may be less flexible |

| Regulation | FCA oversight and consumer protections | Specialist legal work adds complexity |

| Deposit | Encourages responsible leverage | Higher upfront cash requirement |

Before you commit

Think about how long you plan to stay in the property. Some plans are not ideal if you may move within a couple of years, as legal and admin costs can quickly outweigh the benefits. Review how payments are calculated, especially if rent is linked to a benchmark rate. Understand exactly when legal ownership transfers and what happens if you need a payment holiday or to change term length. Plan for maintenance and insurance costs from day one, as these typically sit with you even where the bank retains a share. Finally, request a full breakdown of total cost over the term compared with realistic alternatives so you can make a balanced, confident decision.

Ethical and practical alternatives

- Save longer for a larger deposit to widen plan choices and improve monthly affordability.

- Sharia-compliant shared ownership with staircasing over time to manage entry costs.

- Buy a smaller property now and upgrade later as your equity grows.

- Family co-buying arrangements structured in a halal-compliant way with clear legal agreements.

- Consider refinancing an existing property onto a halal plan to align with principles.

Frequently asked questions

Q: Are Islamic home purchase plans available to non-Muslims? A: Yes. These are regulated UK financial products focused on ethical, asset-based finance. Anyone who meets eligibility criteria can apply.

Q: How much deposit will I need? A: Most providers ask for at least 20 percent. Some require more, depending on property value, applicant profile, and product type. Bigger deposits can mean better terms.

Q: Which option is most popular in the UK? A: Diminishing Musharaka is widely used. You co-own the property with the bank, pay rent on their share, and buy it out over time until you hold full ownership.

Q: How do monthly payments work without interest? A: Payments reflect rent for the bank’s share or agreed profit on a sale to you. They are not interest. The calculation method will be set out clearly in your agreement.

Q: Can I move or repay early? A: Many plans allow early purchase of the bank’s share. Check for any admin or legal fees, and confirm how rent or profit is adjusted on early changes.

Q: Who pays for insurance and repairs? A: You normally handle buildings insurance and maintenance from the start, even if the bank holds a share. This will be stated in your contract.

Q: Are providers like Gatehouse Bank and Al Rayan regulated? A: Yes. UK Islamic HPP providers are regulated by the Financial Conduct Authority, offering similar consumer protections to conventional mortgages.

What to do next

If a halal route feels right, compare a few providers side by side and request written illustrations that show total cost and flexibility. Kandoo can introduce you to regulated specialists who understand Islamic home finance and can help you secure an Agreement in Principle quickly. A short discovery call can clarify your deposit target, the most suitable plan type, and how to structure an offer with confidence.

Important information

This guide is general information, not personal advice. Product features, eligibility and costs vary by provider and your circumstances. Always read the full terms and seek regulated advice where needed. Your home may be at risk if you do not keep up payments.

Get smarter with your money

Join thousands of people in the UK who are taking control of their financial future

FAQs

Common questions about managing your personal finances

Begin by tracking every expense for one month. Use an app or spreadsheet. No judgment. Just observe your spending patterns.

Cancel unused subscriptions. Cook at home. Compare utility providers. Small changes add up quickly.

Aim for 20% of your income. Start smaller if needed. Consistency matters more than the amount.

Choose reputable apps with strong security. Read reviews. Check privacy policies. Protect your financial data.

Pay bills on time. Keep credit card balances low. Check your credit report annually. Be patient.

Still have questions?

Our team is ready to help you navigate your financial journey

More financial insights

Explore our latest articles on personal finance and money management