Practical, GB-focused tips to reduce prepayment energy costs, avoid fees, budget confidently, and choose smarter tariffs with your smart prepay meter.

A straightforward path to lower prepay bills

Prepayment meters used to be the pricey option. That has changed. Recent reforms mean prepay customers now typically pay the least on default tariffs, with the price cap making prepay cheaper than Direct Debit across England, Scotland and Wales. From January to March 2025, the typical prepay cap is around £1,690 for a dual-fuel home, compared with roughly £1,738 by Direct Debit. For many households, that is welcome news during a tough winter.

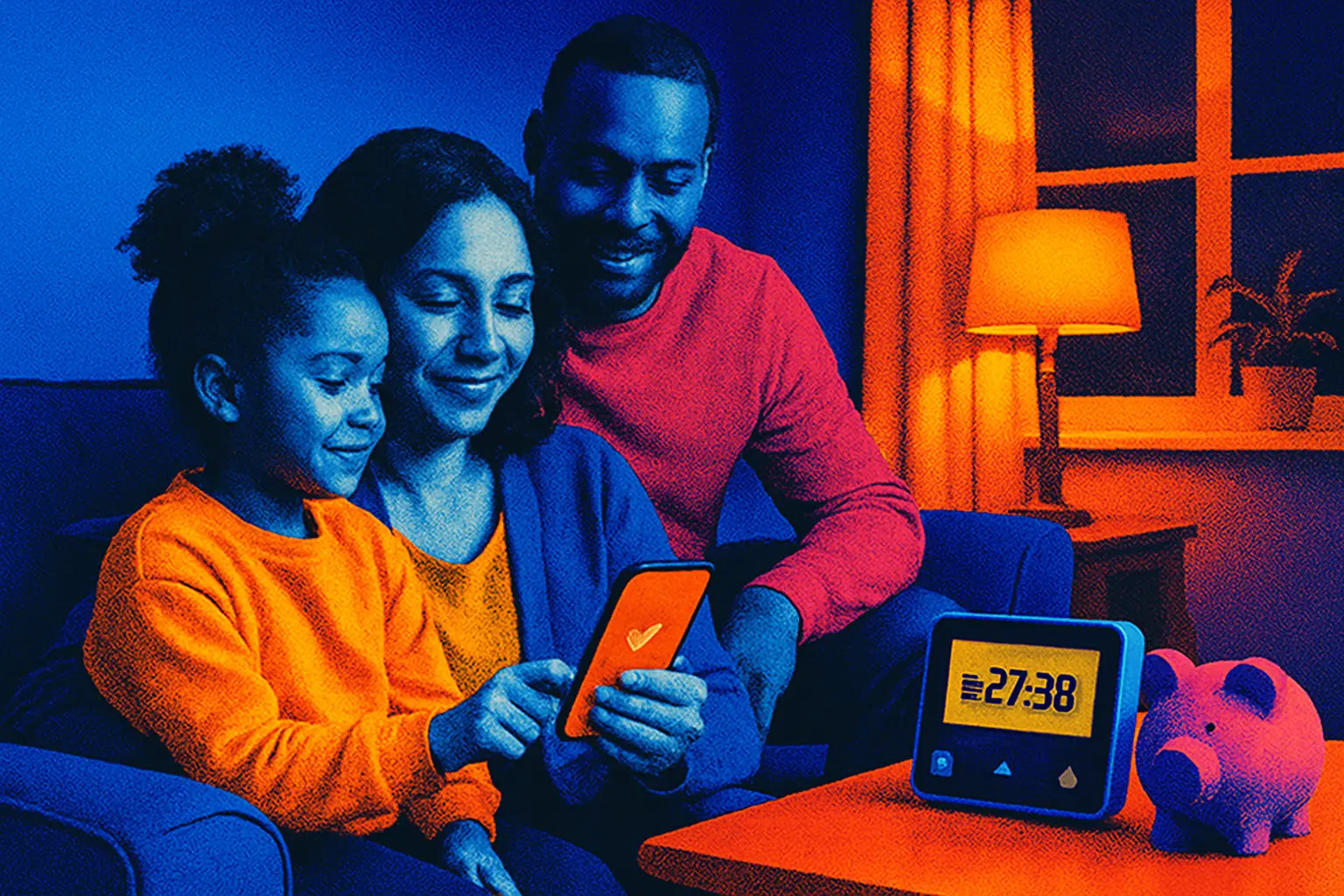

Smart prepay meters make budgeting easier too. You can top up by app or online, monitor usage in real time and get low-balance alerts. Emergency and Friendly Credit act as a safety net so you are less likely to lose supply when funds are tight.

There are still moving parts to understand. Regional standing charges vary, fixed prepay tariffs are fewer than Direct Debit deals, and rates can rise with each cap update. From October to December 2025, prepay unit rates are set to tick up by around 2% under Ofgem rules. This guide explains the key choices in plain English, so you can save money without surprises.

No jargon. No guesswork. Just clear steps to make prepay work for your budget.

Who benefits most

If you prefer firm control over what you spend, live on a tight budget, do not want surprise bills or simply do not use a bank account, prepay can be a good fit. Over 4.5 million UK homes already use it to manage daily energy costs with confidence.

What prepay really means for your wallet

Prepayment energy works like pay-as-you-go. You add credit in advance, use energy, then top up again. Thanks to reforms that ended the prepay premium, standard variable prepay tariffs are now typically the cheapest default option under the Ofgem price cap. In 2024, average prepay electricity bills were lower than both standard credit and Direct Debit, and that advantage continues into 2025 for many households.

Typical annual costs vary by usage, region and payment type. On the current cap, a typical prepay dual-fuel bill sits around £1,707 to £1,711 a year. From January to March 2025, guidance points to roughly £1,690 for prepay vs £1,738 for Direct Debit. The cap sets maximum unit rates and standing charges, not a hard limit on your bill. Use more and you will pay more, use less and you will pay less.

Smart prepay meters remove a lot of hassle. Top up by app, phone or online rather than visiting a shop. Real-time usage through the in-home display helps you spot waste and adjust habits quickly. For many urban households, shaving even £1 to £2 in shop fees per visit by topping up online can add up.

How to squeeze the most value

Start by switching to a smart prepay meter if you still use a key or card. Most suppliers offer upgrades at no extra cost, and credit is added remotely so you will not need to keep track of a plastic key.

Consider fixed prepay tariffs if you want predictability. These lock your unit rates and standing charges for a set period, protecting you from cap increases. They are less common than Direct Debit fixed deals, but they do exist. Always check early exit fees and whether your smart meter is compatible.

Keep an eye on your standing charge and unit rates. From October to December 2025, typical prepay electricity might be around 25.54p per kWh with about 53.68p per day standing, while gas may sit around 6.06p per kWh and 34.03p per day. Regional differences apply, so your numbers may vary.

Small changes matter - track usage weekly and top up before weekends to avoid low-balance stress.

Why prepay can be the cheapest default right now

Reforms have largely levelled the playing field, and in many cases tilted it in favour of prepay users. Standard variable prepay tariffs are currently cheaper than Direct Debit for typical households, reversing years of higher costs for those paying in advance. That helps households who want tight control, clear visibility and fewer surprises.

Smart features strengthen that control. Low balance alerts let you act early. Real-time spend means you can adjust the thermostat or timing of appliances and see the effect within hours. Emergency and Friendly Credit give a cushion overnight or at weekends so you do not lose heat or hot water at awkward times.

Price caps still move. A modest rise is expected later in 2025. Locking into a fixed prepay deal can be sensible if the numbers stack up and you value certainty. If not, staying on the cap remains a fair option.

Payment type comparison at a glance

| Payment type | Typical annual cost on cap | Key benefit | Watch out for |

|---|---|---|---|

| Prepay | ~£1,690 to £1,711 | Strong budgeting control, no surprise bills | Regional standing charges, fewer fixed deals |

| Direct Debit | ~£1,738 | Wider choice of fixed tariffs | Can overpay via estimates if not monitored |

| Standard credit | Higher than prepay on average | Flexibility to pay on receipt | Risk of bill shocks and missed payments |

Pros and cons of prepay

| Pros | Cons |

|---|---|

| Usually the cheapest default on the cap in 2025 | Fewer fixed prepay deals to choose from |

| Pay-as-you-go control with no surprise bills | Standing charges vary by region |

| Smart top-ups by app or online save time and fees | Manual top-ups needed if you lack smart functionality |

| Emergency and Friendly Credit soften low-balance risks | If you forget to top up, supply can still stop |

| No bank account needed to manage energy spend | Some households may prefer monthly predictability |

Costs and pitfalls to keep in mind

Regional differences can be significant. Electricity standing charges range roughly from the mid 40p to high 60p per day, with unit rates also varying. Southern England often has lower electricity standing charges than parts of North Wales, for example. Your actual bill depends on how much you use and your local network costs. If you rely on shop top-ups, factor in potential PayPoint fees and travel. Upgrading to a smart meter can remove most of that friction.

Be clear on emergency credit rules. Suppliers typically offer £5 to £20 per fuel, plus Friendly Credit overnight and at weekends. It is there to help, not to replace regular top-ups. Keep an eye on fixed tariffs too. While they can shield you from 2% or larger cap rises, check any exit fees and ensure the fixed rates genuinely beat your expected variable costs.

Other ways to manage energy spend

- Look for fixed prepay tariffs to lock in rates for 6 to 12 months.

- Use your in-home display to identify high-usage habits and shift use to off-peak times where relevant.

- Top up via app or online to avoid shop fees and keep a digital trail.

- Build a small emergency float on your meter to avoid last-minute trips.

- Improve efficiency - draft proofing, LED bulbs, radiator balancing, and correct boiler settings.

- Check if you qualify for support schemes or supplier assistance funds.

Common questions answered

Is prepay really cheaper than Direct Debit now?

Yes, on standard price-capped tariffs many households pay less on prepay than by Direct Debit. Typical figures for early 2025 put prepay around £1,690 to £1,711 versus roughly £1,738 for Direct Debit.

Will my energy cut off if I run out of credit?

If your balance runs low, emergency credit can activate. Most suppliers also offer Friendly Credit overnight and at weekends so you can top up the next day.

Can I top up without going to a shop?

With a smart prepay meter you can top up by app, online or phone. Credit is added remotely and you can track usage in real time using your in-home display.

Are fixed prepay tariffs worth it?

They can be. Fixed deals lock your unit rates and standing charges, protecting you from cap increases. Compare the fixed rates against your expected usage and check any exit fees.

Why do my rates differ from friends in another region?

Standing charges and unit rates vary by region due to local network costs. For example, some Southern areas have lower electricity standing charges than parts of North Wales.

How Switcha supports smarter prepay savings

Switcha is built to make the numbers simple. We pull in the latest GB price cap data, regional standing charges and typical unit rates so you can see what you are likely to pay before you commit. If a fixed prepay tariff is a better fit, we will highlight it clearly, including any exit fees and eligibility rules. Prefer to stay on the cap for now? We will show how your usage translates into top-ups over a week, a month and a year so you can plan with confidence.

We are independent, plain-English and focused on helping you spend less without cutting corners. Whether you are moving to smart prepay, comparing fixed options or simply trying to avoid shop fees, Switcha gives you clear guidance and simple steps to get there.

Next steps: check your meter type, confirm your regional rates, compare a fixed prepay deal, then set up app top-ups and low-balance alerts.

Important information

This guide provides general information for GB households and is not personalised advice. Energy prices, standing charges and tariffs change regularly. Always confirm current rates with your supplier before switching or fixing.

Get smarter with your money

Join thousands of people in the UK who are taking control of their financial future

FAQs

Common questions about managing your personal finances

Begin by tracking every expense for one month. Use an app or spreadsheet. No judgment. Just observe your spending patterns.

Cancel unused subscriptions. Cook at home. Compare utility providers. Small changes add up quickly.

Aim for 20% of your income. Start smaller if needed. Consistency matters more than the amount.

Choose reputable apps with strong security. Read reviews. Check privacy policies. Protect your financial data.

Pay bills on time. Keep credit card balances low. Check your credit report annually. Be patient.

Still have questions?

Our team is ready to help you navigate your financial journey

More financial insights

Explore our latest articles on personal finance and money management