A plain-English guide for UK senders comparing fees, speeds and delivery options for transfers to India, with provider picks, safety checks and money-saving tips.

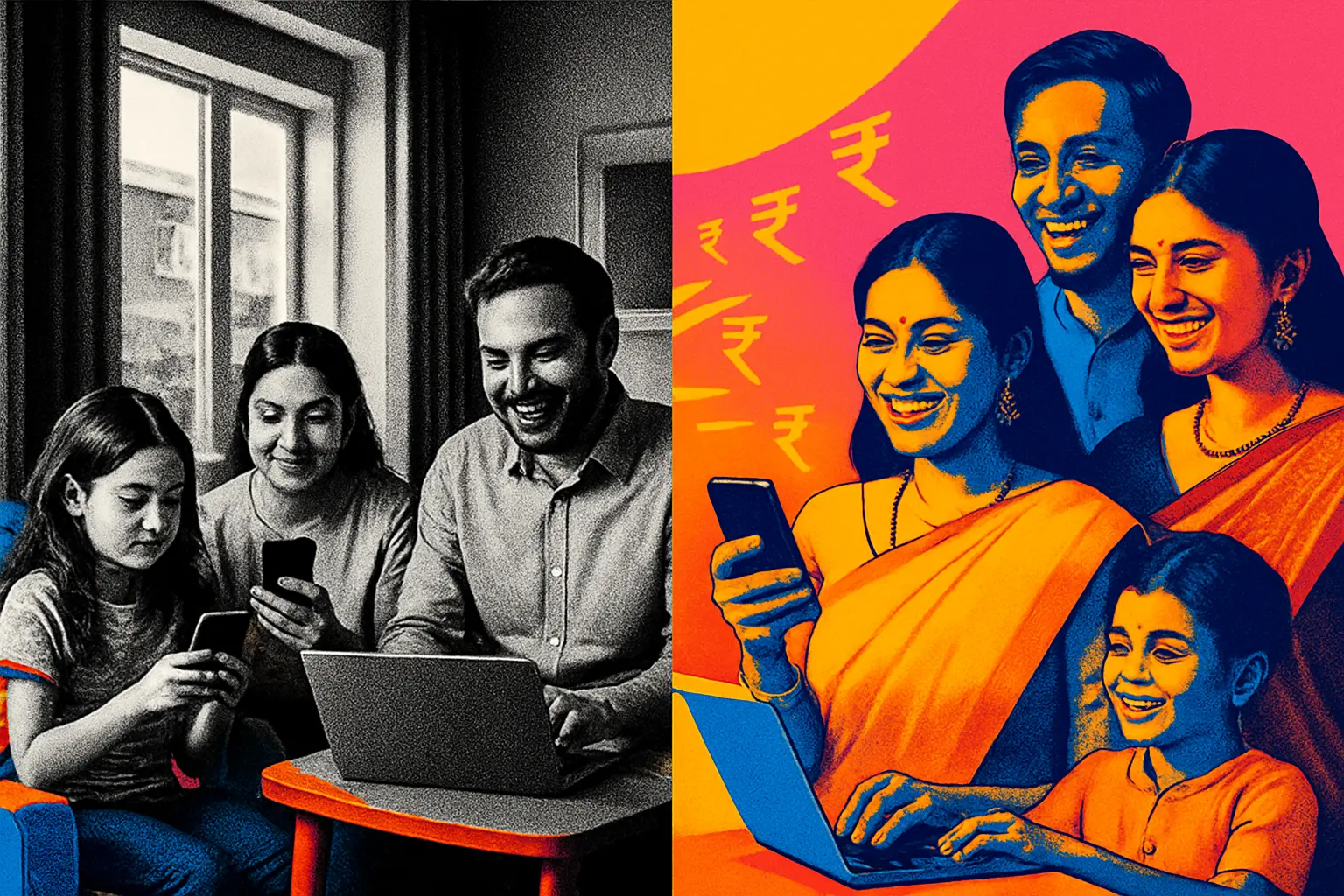

Sending money made simple

Sending money to family or paying bills in India should be quick, secure and fairly priced. Yet fees, exchange rates and delivery choices can make things feel complicated. This guide cuts through the noise so you can choose a route that fits your needs without paying over the odds. We focus on trusted options used by people in the UK every day, including instant UPI and bank transfers, cash pickup for recipients without accounts, and app-based services that show fees up front.

Tip: Check the exchange rate and total fees together. A low fee can be outweighed by a poor rate.

The goal is simple: get more rupees to your recipient, safely and on time.

Who will find this helpful

If you live in the UK and send money to India for family support, education, medical bills or larger one-off commitments, this guide is for you. It is written in plain English, suits first-time senders and regular remitters alike, and focuses on trusted, UK-accessible services.

What matters when choosing a service

The best service is the one that balances cost, speed and convenience for your situation. Some providers deliver in minutes via UPI or cash pickup. Others focus on bank-to-bank reliability for larger amounts. Look at the total cost - fee plus the exchange rate - along with delivery choices like bank deposit, UPI, cash pickup or mobile wallet. Security and transparency are vital, so prioritise providers that are regulated in the UK, clearly show the rupee amount before you pay, and offer real-time tracking.

Cash pickup can suit relatives without bank accounts, while UPI is ideal for tech-savvy recipients using mobile payments. Traditional bank SWIFT transfers can work, especially for bigger sums, but often cost more and take longer. With the right fit, you can save money and reduce delays.

Step-by-step: from pounds to rupees

Start by deciding what matters most today: price, speed, or how your recipient wants to receive the money. Then compare a few reputable services, set up your account, verify your ID, and send a small test payment if time allows. Keep receipts and tracking details handy.

Quick comparison of popular UK-to-India options

| Provider | Fees (from) | Typical speed | Delivery options | Best for | UK payment methods |

|---|---|---|---|---|---|

| Money2India UK (ICICI) | Low, often competitive | Instant to minutes | Bank deposit | Urgent family support via bank | UK bank transfer, debit card |

| Remitly | From £1.99 | Minutes for UPI/cash; hours for bank | UPI, bank deposit, cash pickup | Small frequent sends and flexibility | Debit/credit card, bank transfer |

| Western Union | £0 online, £2.90-£5.90 cash | Minutes for pickup; instant UPI/bank | Cash pickup, UPI, bank deposit | In-person sends via Post Office | Cash, card, online/app |

| Revolut | Low, shown in real time | Seconds to minutes | Bank transfer, card to card (where supported) | App-first low-fee speed | Bank transfer, card, payment link |

| SBI UK | Bank rates; no hidden mark-ups | Around 2-24 hours | Bank deposit to any Indian bank | Larger amounts with bank reliability | Online/mobile banking |

Next steps:

- Check today’s GBP-INR rate and the total you will pay.

- Confirm delivery type suits your recipient - bank, UPI or cash pickup.

- Verify your transfer limit covers the amount you need to send.

Why the route you choose matters

Choosing the right service can add thousands of rupees to the amount received over a year. Online specialists often beat traditional bank SWIFT transfers on both fees and speed. If your recipient needs cash today, a provider with instant UPI or cash pickup could be worth a slightly higher fee. For larger transfers, a bank-backed route with clear daily limits and tracking can help you avoid repeated payments and extra charges. Convenience also matters: if you prefer in-person help, the UK Post Office network linked to Western Union makes sending straightforward without a full online setup. The right fit keeps costs predictable and reduces stress for both you and your recipient.

Pros and cons at a glance

| Option | Pros | Cons |

|---|---|---|

| Dedicated remittance apps (ICICI Money2India, Remitly) | Competitive rates, instant or near-instant delivery, clear tracking | Limits may apply; fees vary by speed and method |

| In-person via Post Office (Western Union) | Nationwide access, cash payments accepted, minutes for pickup | Counter fees can be higher than online prices |

| App-first fintech (Revolut) | Low fees, real-time cost display, very fast settlement | Recipient options may be narrower; features vary by country |

| Bank-to-bank with SBI UK | Trusted for larger amounts, familiar banking channels | Usually slower than instant UPI; exchange rate may vary |

| Traditional bank SWIFT | Useful for some large payments and compliance needs | Multiple intermediary fees, slower delivery, weaker rates |

Watchouts before you hit send

Always check the full cost: combine the fee with the exchange rate to see the exact rupee amount your recipient will get. Confirm the delivery method - UPI, bank deposit or cash pickup - and make sure your recipient’s details match their official records to prevent delays or rejection. For UPI, verify their ID and name. For bank transfers, match the account name, IFSC and account number carefully. If you are sending a larger sum, check provider limits in advance and be ready to upload ID and source-of-funds documents. When using in-person services, double-check opening hours and carry acceptable ID. Finally, watch for scams: only send to people you know and never share security codes. If something feels off, pause and contact the provider’s support team.

Other routes if your first choice is full

- MoneyGram - wide agent network for cash pickup and online sends.

- Wise - transparent mid-market rate and bank deposits.

- PayPal to bank partner routes - convenient for some users, fees vary.

- UK bank SWIFT - suitable when you must use your bank, expect higher costs.

- Split transfers over several days to stay within provider limits.

Common questions, clear answers

Q: How fast can money arrive in India? A: UPI and cash pickup can be near-instant. App-to-bank deposits are often minutes to a few hours. Traditional bank transfers can take 1-3 working days.

Q: What is the cheapest way to send? A: Compare the total cost - fee plus rate - across two or three providers before paying. App-based services often beat high-street bank SWIFT transfers on overall value.

Q: Can I send to someone without a bank account? A: Yes. Cash pickup via providers like Western Union or Remitly allows recipients to collect cash at local agents with ID, usually within minutes.

Q: Are large transfers allowed from the UK? A: Yes, but limits apply. For example, some bank channels allow up to around £25,000 per day. Expect ID and source-of-funds checks for compliance.

Q: Is UPI safe for international transfers? A: UPI routes offered by regulated providers are designed with security checks and deliver quickly. Always confirm the recipient’s UPI ID and name before sending.

Where Switcha fits in

Switcha helps you compare trusted UK-to-India transfer routes in plain English, so you can see fees, exchange rates, delivery options and limits side by side. We point you to regulated providers that fit your priorities - speed for emergencies, cash pickup for unbanked recipients, or cost-efficient bank deposits for regular remittances. With clear guidance and practical tips, you can send with confidence and keep more of your money working for your family. If you are unsure where to start, use Switcha to shortlist two or three options, check today’s total costs, and choose the one that gets the most rupees to your recipient safely.

Important information

This guide is for general information only and is not financial advice. Always check provider terms, limits and fees before sending. Availability, pricing and speeds can change. If you need personalised advice, speak to a qualified professional.

Get smarter with your money

Join thousands of people in the UK who are taking control of their financial future

FAQs

Common questions about managing your personal finances

Begin by tracking every expense for one month. Use an app or spreadsheet. No judgment. Just observe your spending patterns.

Cancel unused subscriptions. Cook at home. Compare utility providers. Small changes add up quickly.

Aim for 20% of your income. Start smaller if needed. Consistency matters more than the amount.

Choose reputable apps with strong security. Read reviews. Check privacy policies. Protect your financial data.

Pay bills on time. Keep credit card balances low. Check your credit report annually. Be patient.

Still have questions?

Our team is ready to help you navigate your financial journey

More financial insights

Explore our latest articles on personal finance and money management