Understand UK black box insurance - how it works, who benefits, costs, privacy, pros and cons, and safe steps to compare policies with confidence.

A straightforward look at telematics car insurance

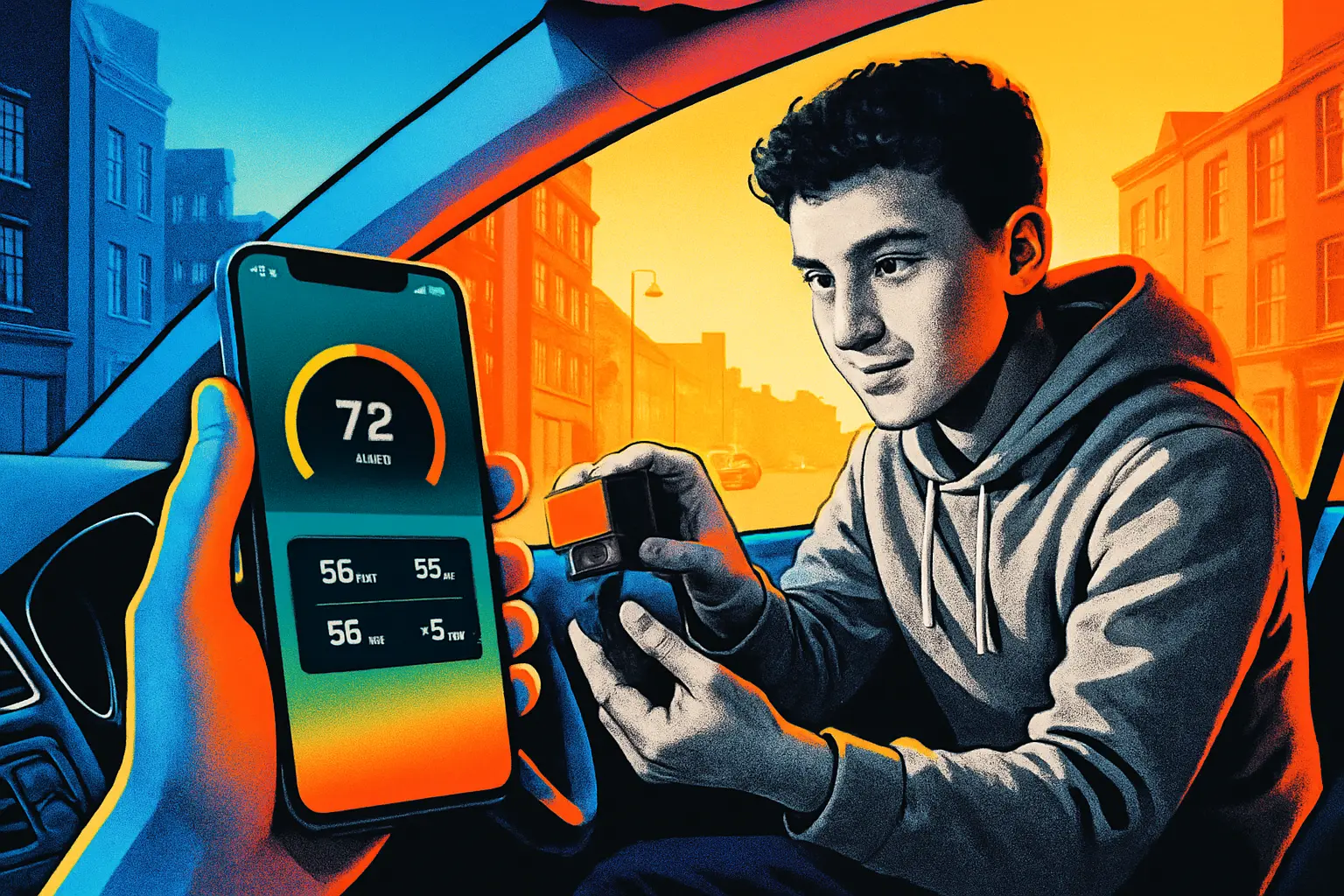

Black box - also called telematics - insurance links the cost of your car cover to how you actually drive. A small device in your car or a smartphone app records things like speed, smoothness, time of day, and mileage. Safer habits can lead to lower premiums, while riskier patterns may reduce discounts. It is designed to be fairer than one-size-fits-all pricing and to encourage safer driving.

In the UK, uptake has grown steadily. Around 455,000 drivers now use a black box, compared with only a few hundred thousand a decade ago. This growth reflects two things most drivers care about - cost and safety. Premiums have risen sharply in recent years, so many people are looking for practical ways to save. Independent studies suggest telematics can reduce collision risk by up to 40%, and some policies offer discounts up to 25% for consistently safe driving. Newer options use your phone, which makes getting started easier for those who prefer not to fit hardware.

Telematics is not only for young drivers. Older motorists, low-mileage commuters, and shift workers who can plan within curfew rules may benefit. At the same time, it will not suit everyone. Some people simply prefer traditional cover. Others have concerns about how their data is used. Surveys show most UK drivers have heard of telematics and many are open to trying it at renewal, yet a clear majority still want reassurance about privacy and security before they switch. This guide sets out the facts so you can decide with confidence.

Clear information builds trust. Know what is recorded, how it is used, and your options if you disagree with a score.

What is covered and how the tech works in practice

Telematics does not change the legal categories of car insurance. You will still choose comprehensive, third party, fire and theft, or third party only. The telematics element sits on top and adjusts pricing and conditions based on your driving data. The device or app records events like acceleration, braking, cornering, speed versus the limit, time of day, and total mileage. Insurers translate these into a score and may review it monthly or at renewal. Consistent safe driving can earn lower prices or cashback. Risky patterns can reduce rewards or trigger guidance.

Claims work much like standard policies. If you have an accident, you contact the insurer, share details, and follow the claims process. The black box or app data may support assessment of what happened. For example, data could show your speed at impact or whether harsh braking occurred. This can help resolve disputes, but it does not guarantee an outcome in your favour. If the data indicates rules were breached - such as repeated speeding or driving during a curfew - some policies may reduce benefits or apply fees. There are also limits. Telematics does not override core exclusions like driving without a licence, being unfit through drink or drugs, or using a vehicle for undeclared business purposes. If you change your car, you might need device reinstallation or to pair a new phone. Always check the policy booklet for exact terms.

Who benefits - and who may not

Telematics can help drivers who want fairer pricing based on real behaviour. Young drivers facing high premiums often see meaningful savings if they drive smoothly, keep to limits, and avoid late-night trips. Older motorists who already drive cautiously can also benefit. Low-mileage drivers, rural commuters, and those with clean records may find the scoring naturally plays to their strengths. Parents adding a new driver to a family car sometimes use black box policies to build good habits from the start.

It may be less suitable if your driving pattern is hard to control. Regular late-night work, frequent long motorway trips at peak times, or high annual mileage can lower your score on some policies. If you are uncomfortable sharing location data, prefer not to fit hardware, or cannot commit to a charged and mounted smartphone on every trip, you might prefer a standard policy. The key is to match the product to your lifestyle and privacy expectations.

Your choices at a glance

-

Basic telematics - app only

- Uses your smartphone for GPS and motion sensing. No device fitting required.

- Usually the cheapest entry point with immediate setup and real-time feedback.

- May require the phone to be mounted, charged, and carried on every trip.

-

Standard telematics - plug-in or self-fit box

- Small device connects to your car via power socket or windscreen placement.

- More consistent data capture than a phone alone and fewer interruptions.

- Often includes clear dashboards, trip scoring, and monthly performance reviews.

-

Premium telematics - professionally fitted black box

- Hardwired device with calibrated sensors and tamper alerts for data reliability.

- May support theft tracking and advanced crash detection for faster assistance.

- Typically higher upfront or fitting costs but stronger fraud protection benefits.

-

Optional add-ons

- Breakdown cover integration - some providers include roadside assistance.

- Courtesy car upgrade - extends availability after a fault claim.

- Legal expenses - support for uninsured loss recovery after non-fault incidents.

- Windscreen cover - repairs and replacement with lower excesses.

- International use - extends cover to specific European countries for limited periods.

Pick based on practicality: app convenience, self-fit flexibility, or fixed-box reliability.

Cost, pricing and what affects your premium

| Factor | Typical impact on price | Why it matters |

|---|---|---|

| Age and experience | Large impact | New and young drivers face higher baseline risk and prices. |

| Location | Moderate to large | Urban areas can have higher theft and accident frequency. |

| Annual mileage | Moderate | More miles increase exposure to potential claims. |

| Driving score | Large | Smooth driving and speed compliance can unlock discounts up to 25%. |

| Time of day | Moderate | Late-night driving can reduce scores on some policies. |

| Claims and convictions | Large | Recent claims or points usually increase premiums. |

| Cover level and add-ons | Moderate | Comprehensive cover and extras raise costs but add protection. |

| Device type | Small to moderate | App-only can be cheaper to start; fitted boxes may add fees. |

Rising UK premiums - reported increases of roughly 25-30% year-on-year - are pushing more drivers to consider telematics for cost control.

Eligibility and what insurers may ask for

Most UK insurers accept full UK licence holders and, in many cases, provisional licence holders on learner or young driver policies. Eligibility varies by age, postcode, vehicle group, and claims history. Some providers set minimum and maximum age limits or exclude certain performance vehicles. If the policy needs a fitted device, you will be asked to book installation and keep the box powered. App-based cover usually requires a compatible smartphone, permissions for location and motion data, and agreement to keep the app active for all journeys.

Insurers generally ask for accurate details on mileage, usage, and any convictions. Proofs can include driving licence numbers, no-claims discount documents, and proof of address. Common reasons for decline include high-risk modifications, undisclosed claims, inconsistent information, or repeated policy breaches such as tampering with the device or failing to record trips. If you are unsure, ask the insurer to confirm requirements before you buy.

From quote to claim - the simple route

- Get quotes from several providers and compare features, not just price.

- Confirm your preferred device type - app, self-fit, or fitted box.

- Check how scoring works, curfews, mileage caps, and any fees.

- Complete the application with accurate details and declarations.

- Arrange installation or download and set up the app promptly.

- Drive normally for a few weeks to establish your baseline score.

- Review feedback, adjust habits, and track any discounts applied.

- If an incident happens, report it quickly and follow claims guidance.

Balanced view - strengths and trade-offs

| Pros | Cons |

|---|---|

| Potential savings for safe drivers, including young motorists | Not all drivers will save - risky patterns can reduce discounts |

| Real-time feedback encourages safer habits and fewer collisions | Curfews or mileage caps may limit flexibility for shift or high-mileage drivers |

| Fairer pricing based on how you drive, not just age or postcode | Privacy concerns - many drivers want clearer data control and security |

| Theft tracking and crash alerts with some fitted devices | Device or app issues can interrupt trips or cause admin hassle |

| Growing choice - app-based and device options across the UK | Switching mid-term can involve fees or device removal costs |

Before you commit - key checks that protect you

Read the policy booklet carefully so you know exactly what is recorded, how the score affects pricing, and when fees might apply. Look for excess amounts, any curfew rules, and limits on annual mileage. Confirm whether the insurer can adjust premiums mid-term or only at renewal, and whether a low score could lead to cancellation. Check data policies - what is collected, how long it is stored, and who can access it. If a device is fitted, ask about installation times, removal costs, and what happens when you change car. Finally, keep proof of your no-claims discount and any named driver details ready to speed up onboarding.

Related options that might fit better

- Standard comprehensive car insurance - if you prefer not to share driving data or want full flexibility without curfews.

- Pay-per-mile insurance - suitable for very low-mileage drivers who rarely use the car.

- Short-term or temporary car insurance - useful for occasional use or borrowing a car.

- Classic car or limited mileage policies - for older vehicles driven infrequently and kept garaged.

- Named driver on a family policy - can lower costs for new drivers with supervised use.

Common questions, clear answers

Q: Will I definitely pay less with a black box? A: No. Many drivers save, but discounts are not guaranteed. Savings depend on your driving score, mileage, location, claims history, and policy terms. Some drivers see no change or pay more.

Q: What data is collected and who sees it? A: Typically speed, location, braking, acceleration, cornering, time of day, and mileage. The insurer and authorised partners process it for pricing, safety feedback, and claims investigation, under UK data protection rules.

Q: Is a smartphone app as good as a fitted box? A: Apps are convenient and cheaper to start, but rely on phone battery, mounting, and permissions. Fitted boxes provide more consistent data and anti-tamper features, often preferred for robust scoring.

Q: Can telematics help young drivers? A: Yes. Young drivers face higher premiums, and telematics can reward safe habits with lower costs over time. It also builds a positive driving record that may help at renewal.

Q: Do privacy concerns affect uptake? A: Yes. Many UK drivers are cautious about sharing location and driving data. Transparent policies, security assurances, and clear control over data access can improve confidence.

Q: What happens if I break a curfew? A: Policies vary. Some apply warnings or reduce discounts, others may charge fees. Repeated breaches could lead to cancellation. Always check the specific terms before buying.

Q: What if I change car during the policy? A: Tell your insurer first. You may need to move the device, book a new installation, or re-pair the app. Charges and timelines vary by provider.

What to do next

If telematics feels suitable, compare a few UK providers and look beyond headline prices. Check scoring rules, data use, curfew limits, and fees so there are no surprises. Take your time, read the documents, and only proceed when the policy fits your driving pattern and privacy preferences. You stay in control throughout.

Important information

This guide is general information, not personal financial advice. Policy features, eligibility, and pricing vary by insurer. Always read the policy documents, including exclusions and data terms, and ask the provider to confirm anything that is unclear before you buy.

Get smarter with your money

Join thousands of people in the UK who are taking control of their financial future

FAQs

Common questions about managing your personal finances

Begin by tracking every expense for one month. Use an app or spreadsheet. No judgment. Just observe your spending patterns.

Cancel unused subscriptions. Cook at home. Compare utility providers. Small changes add up quickly.

Aim for 20% of your income. Start smaller if needed. Consistency matters more than the amount.

Choose reputable apps with strong security. Read reviews. Check privacy policies. Protect your financial data.

Pay bills on time. Keep credit card balances low. Check your credit report annually. Be patient.

Still have questions?

Our team is ready to help you navigate your financial journey

More financial insights

Explore our latest articles on personal finance and money management