A calm, practical guide to UK musical instrument insurance, covering what’s included, costs, eligibility, and smart ways to protect your instrument without overspending.

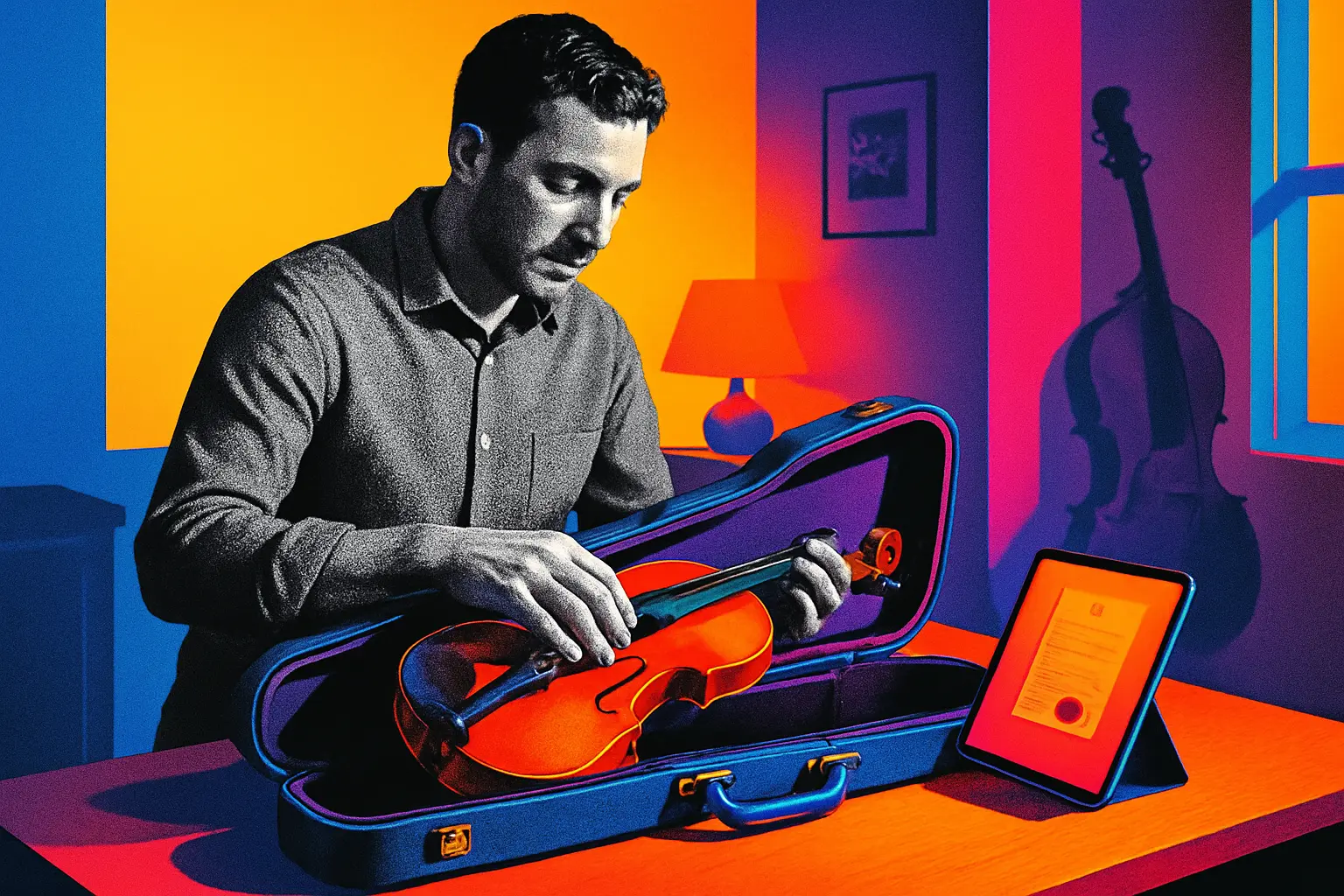

Why protecting your instrument matters

The UK music scene is thriving. In recent years it contributed roughly £8 billion to the economy, with more professionals, students and hobbyists making and performing music across the country. As more instruments are bought, borrowed, taught and toured, the risk of theft, accidental damage and loss grows too. Musical instrument insurance is designed to step in when things go wrong, helping you repair or replace an instrument so your practice or performance is not derailed.

Insurance is not a shortcut to perfect protection, and it will not prevent loss. It is a financial safety net that works best when you understand what is covered and where the limits sit. Policies can be tailored for different needs - from a student violin on weekly school runs to a touring guitarist travelling worldwide. With the market growing strongly, providers are introducing clearer wording, digital claims, and options that reflect how musicians actually use their gear.

This guide walks you through the essential points in plain English. You will find what typical policies cover, where exclusions often apply, what affects price, and how to compare options safely. The aim is to help you decide whether cover is right for you, set realistic expectations, and avoid common pitfalls that can lead to declined claims. No jargon, no hype - just practical, balanced information so you can make an informed choice.

Insurance should remove uncertainty, not add to it. Clarity today prevents disputes later.

What is usually covered and how claims work

Most musical instrument policies cover theft, accidental damage and loss, both at home and while travelling. Cover can extend to accessories, cases, bows, mouthpieces and electronic gear, and can include hire of a temporary replacement so you can keep playing. Higher tiers may include worldwide protection, in-vehicle cover with specified security conditions, and protection during performances or on tour.

There are limits. Wear and tear, gradual deterioration, cosmetic scratches and manufacturing faults are commonly excluded. Leaving an instrument unattended in an unlocked vehicle is usually not covered. For wooden instruments like violins, cellos and acoustic guitars, insurers may restrict cover for cracking or warping caused by humidity or temperature changes. Some policies also set conditions for professional use, performance cancellations, or shipping by courier unless you follow approved packing and tracking requirements.

Claims are typically straightforward: you notify the insurer as soon as possible, provide proof of ownership and value, supply photos and any police reference if theft is involved, and cooperate with repair estimates. Settlement may be repair, replacement, or cash, depending on the policy and availability. For high-value items, insurers often require valuations and may specify named instruments and serial numbers. Transparent documentation speeds up decisions and reduces the risk of disputes.

Simple examples help: if your saxophone is stolen from a locked flat with a police report and proof of ownership, a valid policy should respond. If a violin cracks after being left in a hot car, cover may be declined due to environmental exposure and unattended-vehicle exclusions. Knowing these boundaries helps you plan storage and travel safely.

Who is likely to benefit

This cover suits professional musicians, teachers, students and serious amateurs who rely on their instrument to perform, practise or earn income. Ensembles, schools and studios that manage multiple instruments also benefit, especially when instruments move between locations or are lent to students. Touring artists who travel by train, car or plane gain value from worldwide cover and in-vehicle protections when security conditions are met.

It may be less essential if your instrument is inexpensive to replace, you rarely take it outside the home, or it is already adequately covered under a home insurance policy with specified items and accidental damage. However, standard home cover often limits use outside the home and may not include professional use or international travel. If you would struggle to replace your instrument quickly from savings, dedicated cover deserves consideration.

Cover choices at a glance

-

Basic - entry level protection

- Theft, loss and accidental damage at home and locally, with modest limits.

- Often excludes professional use, touring and in-vehicle cover.

- Suitable for students or hobbyists with lower-value instruments kept mainly at home.

-

Standard - broader everyday cover

- Adds travel within the UK, some in-vehicle cover subject to security conditions, and accessory cover.

- May include temporary hire after a claim to keep you playing.

- Good fit for active amateurs, teachers and semi-professionals with regular rehearsals and gigs.

-

Premium - comprehensive and flexible

- Worldwide protection, higher single-item limits, and flexible deductibles.

- Can include transit cover, professional use, and cover during performances and tours.

- Best for professionals and owners of high-value instruments.

-

Optional add-ons

- Unattended vehicle extension with stricter security requirements and time limits.

- Hire instrument cover to ensure continuity while yours is repaired.

- Performance cancellation or disruption cover, including emerging parametric options that trigger payouts after predefined events like extreme weather.

- Technology benefits such as GPS-tracker recognition that can support recovery and may help reduce premiums.

- Accidental damage for accessories like bows, cases, pedals and microphones with specified limits.

Pick a level that mirrors how and where you actually play - not just the price.

What it costs and why prices vary

Average annual premiums for professionals typically range from £100 to £230 for instruments valued between £3,000 and £10,000. Prices vary by instrument type, usage, travel, security and claims history. Strong recent growth in the UK market has increased competition, with digital platforms speeding up quotes and claims. Technology such as GPS tracking and telemetric monitoring can reduce theft risk and may be recognised in pricing. For wooden instruments, climate sensitivity can influence premiums and conditions due to humidity and temperature fluctuations.

| Factor | Typical impact on price | What to consider |

|---|---|---|

| Instrument value | Higher value raises premiums | Provide recent valuations for high-value pieces |

| Instrument type | Fragile or high-theft items may cost more | Wooden instruments may face climate-related conditions |

| Usage pattern | Professional use and frequent gigs increase risk | Disclose paid performances and touring honestly |

| Travel and geography | Worldwide or frequent travel increases cost | Check in-vehicle and transit conditions carefully |

| Security measures | Locks, alarms, GPS tracking can reduce risk | Keep receipts and photos of security steps |

| Claims history | Previous claims can raise premiums | Provide accurate history to avoid disputes |

| Excess amount | Higher excess lowers premium | Ensure the excess is affordable if you claim |

| Multi-instrument cover | Bundling can be cost-effective | Name items and list serial numbers accurately |

Prices are indicative, not guaranteed. Always compare like-for-like cover, limits and excesses.

Eligibility and what insurers expect

Most UK residents can apply, including students and professionals. Insurers usually require you to be over 18 to purchase a policy, with a UK address and bank account. You will be asked for make, model, serial numbers, and approximate value of each instrument. For higher-value items, a recent valuation or purchase receipt is often required. If you perform professionally or tour, declare this so the policy reflects your actual risk.

Common reasons for decline include undisclosed prior claims, uncertain ownership or provenance, repeated losses without improved security, or instruments with existing damage. Policies may exclude wear and tear and may set specific conditions for storage, unattended vehicles and international travel. If you cannot meet these conditions, the insurer may offer restricted cover or decline. Being open about your usage and security measures helps you find a policy that fits.

From quote to claim - the simple path

- Get an online quote with instrument details, values and how you use them.

- Choose a cover level that mirrors your usage and travel patterns.

- Confirm security conditions and agree an excess you can afford.

- Upload receipts, photos and valuations for high-value instruments.

- Review policy wording carefully and purchase when comfortable with terms.

- Store documents safely and keep serial numbers and photos up to date.

- If something happens, notify the insurer promptly with evidence and reports.

- Follow repair or replacement guidance and keep all invoices for settlement.

Benefits and watch-outs

| Pros | Cons and cautions |

|---|---|

| Financial protection for theft, loss and accidental damage | Exclusions for wear and tear and cosmetic damage |

| Options for worldwide cover and professional use | Unattended vehicle restrictions can limit claims |

| Temporary hire to keep you playing after a claim | Excess applies on each claim, which you must budget for |

| Digital quotes and faster claims handling | Incorrect valuations can delay or reduce payouts |

| Potential discounts for security and GPS tracking | Climate-related limits for wooden instruments may apply |

| Flexible deductibles and named-item clarity | Courier or air transit may require specific packing and evidence |

| Tailored add-ons for tours and cancellations | Premiums can rise after claims or at renewal |

Honest disclosure and up-to-date valuations are the simplest ways to protect your claim.

Key checks before you buy

Read the policy schedule and wording, including definitions. Confirm the single-item limit covers your most valuable instrument. Check the excess and make sure it is affordable. Review exclusions for unattended vehicles, environmental damage and professional use. Note any waiting periods before certain benefits start. Ask how transit is defined and what proof is needed for airline or courier claims. Clarify renewal pricing, how premiums may change after a claim, and what documentation is required for valuations. Keep proof of ownership and serial numbers in a secure place and update them after upgrades or repairs.

Alternatives you might consider

- Home insurance with specified items and personal possessions cover - can suit low to mid-value instruments mainly used at home, but may not cover professional use or worldwide travel.

- Business equipment insurance - appropriate if you run a studio, teach, or operate as a limited company and need broader equipment cover plus public liability.

- Event or tour insurance - useful when the main risk is cancellation, liability, or travel disruption across multiple dates and venues.

- Parametric event cover - pays out on predefined triggers like extreme weather cancelling a gig, helpful for predictable cash flow after disruptions.

Common questions, clear answers

Q: Is my instrument covered outside the home? A: Often yes, but only if your policy includes out-of-home or worldwide sections. Check security conditions for vehicles, public spaces and venues, and keep proof if theft occurs.

Q: Do I need a valuation? A: For high-value instruments and bows, yes. A recent valuation or purchase receipt supports accurate sums insured and speeds up claims. Ask your insurer what they accept and how often to update.

Q: What about wooden instruments and climate damage? A: Many policies limit or exclude cracking and warping caused by humidity or temperature. Use proper cases, humidifiers, and storage. Some insurers adjust premiums or conditions for climate-sensitive items.

Q: Can technology like GPS trackers help? A: Yes. Trackers and telemetric monitoring can deter theft and aid recovery. Some insurers recognise these measures and may reflect the reduced risk in pricing or conditions.

Q: How much will it cost me? A: Professionals commonly pay around £100 to £230 per year to cover instruments valued between £3,000 and £10,000. Your price depends on usage, travel, value, security and claims history.

Q: Are cancellations of gigs covered? A: Standard policies may not include cancellation. You can add specific cancellation or parametric cover that pays out when predefined events, such as extreme weather, prevent performance.

Q: Can students get flexible cover? A: Yes. Subscription-style policies exist for students and schools, offering lower-cost, flexible cover that aligns with term times and changing instrument needs.

Ready to compare safely

Take a moment to list your instruments, their values and how you use them. Compare like-for-like cover across a few UK providers, focusing on limits, exclusions and excesses rather than price alone. When the terms feel clear and workable for your routine, you can proceed with confidence.

Next step: gather serial numbers, photos and valuations, then get two or three comparable quotes.

Important note

This guide provides general information, not personal financial advice. Policy terms, limits and exclusions vary by insurer. Always read your policy documents carefully and contact the insurer to confirm what is and is not covered for your situation.

Get smarter with your money

Join thousands of people in the UK who are taking control of their financial future

FAQs

Common questions about managing your personal finances

Begin by tracking every expense for one month. Use an app or spreadsheet. No judgment. Just observe your spending patterns.

Cancel unused subscriptions. Cook at home. Compare utility providers. Small changes add up quickly.

Aim for 20% of your income. Start smaller if needed. Consistency matters more than the amount.

Choose reputable apps with strong security. Read reviews. Check privacy policies. Protect your financial data.

Pay bills on time. Keep credit card balances low. Check your credit report annually. Be patient.

Still have questions?

Our team is ready to help you navigate your financial journey

More financial insights

Explore our latest articles on personal finance and money management