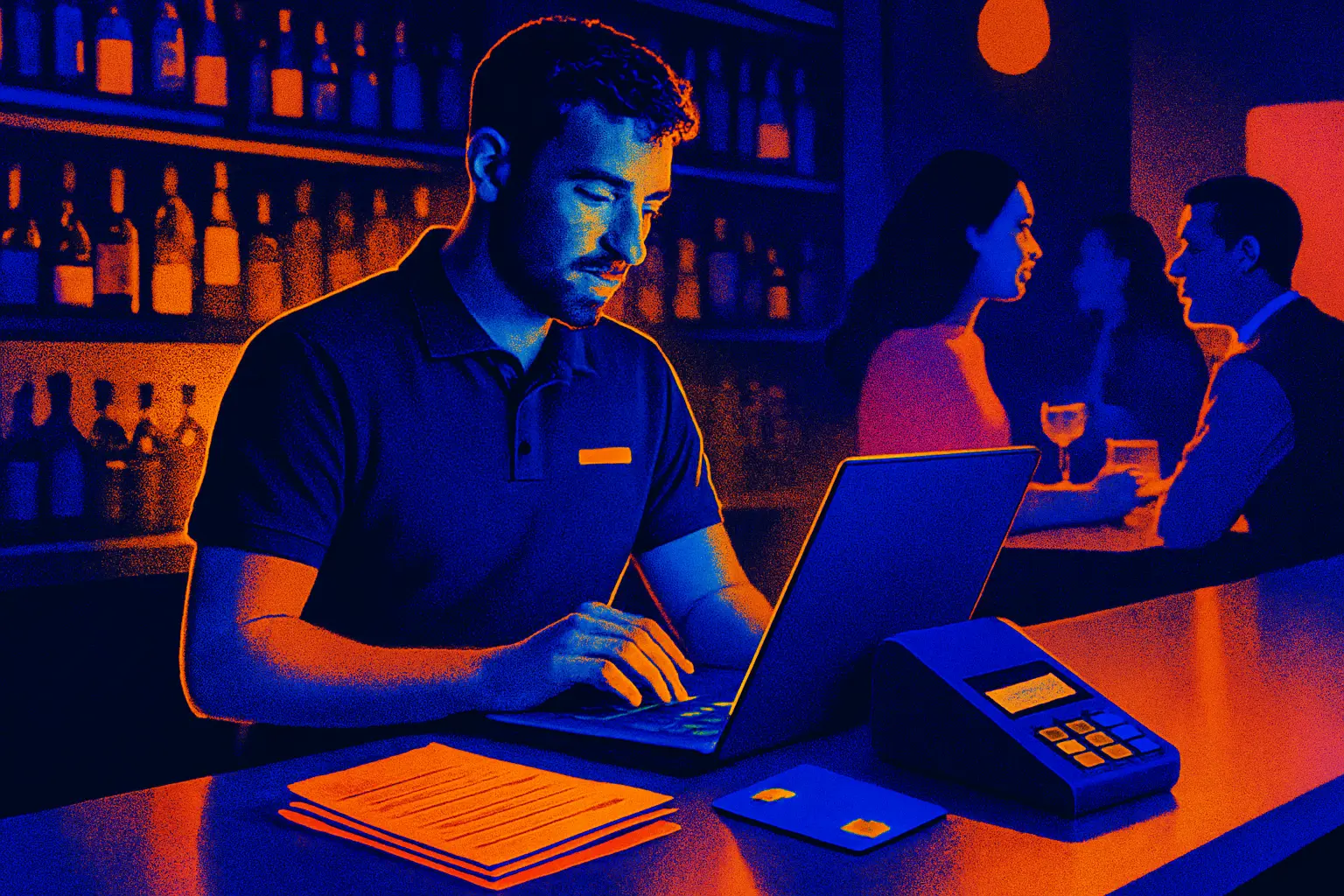

Business Bank Accounts for Bars

What UK bar owners need to know about business bank accounts - safety, fees, features, and how to choose with confidence.

Getting your bar’s money setup right

Running a bar is fast paced, cash heavy, and margin sensitive. Setting up the right business bank account is more than a box to tick - it is the backbone of clean records, smoother cash flow, and fewer tax headaches. If you operate as a limited company or LLP in the UK, a separate business account is a must because your company is a distinct legal entity. Sole traders are not compelled to open a business account, but keeping business and personal money apart is strongly recommended to keep your books clean and to make tax simpler.

Bars often handle high transaction volumes, card settlements and cash banking. That creates extra demands on fees, deposit limits, and the tools you use to pay staff and suppliers. Knowing how protection works - from FSCS coverage at licensed banks to safeguarding at e-money institutions - helps you decide where to hold daily takings and what to spread across providers. This guide walks through what to consider, how to open an account without delays, and which features matter most for UK bars.

Separate business and personal finances to reduce HMRC risk and save time at year end.

Who this guidance will help

If you run a UK bar, pub, cocktail lounge, taproom, or late-night venue - whether you are just opening or switching from a legacy tariff - this is for you. It also suits multi-site operators, sole traders moving to limited company status, and bar managers tasked with improving finance processes without disrupting service.

What a dedicated bar account actually does

A business bank account holds your bar’s money, receives takings, pays staff and suppliers, and links to your accounting software. For limited companies and LLPs, it is essential because the business is a separate legal person. For sole traders, a dedicated account is not legally required, but it keeps records clean and simplifies self-assessment and VAT.

Good accounts support how bars really operate: frequent card settlements, occasional large cash deposits, regular payroll cycles, and supplier runs that can vary each week. Many providers offer tools beyond basic banking - think multi-user access for owners and managers, staff expense cards with spend limits, and real-time notifications so you can spot unusual activity quickly. Some digital players provide sub-accounts or spaces to ringfence VAT or set aside rent and rates. When integrated with accounting software, transactions sync automatically to help you stay on top of Making Tax Digital requirements.

A key safety point is how your money is protected. Fully licensed UK banks typically offer FSCS protection, historically up to £85,000 per eligible business per banking group. Some sources now reference increased limits up to £120,000 - check the latest figure with your provider. E-money institutions do not offer FSCS, but must safeguard client funds in ring-fenced accounts.

How to open an account without delays

Start by choosing the provider that matches your needs. If you expect heavy cash banking or want branch support and overdrafts, a high-street bank may fit. If you need fast onboarding, intuitive controls and low-cost international transfers for imported spirits or equipment, a digital challenger can be ideal. Many bars use a hybrid setup - a main high-street account plus a fintech account for POS payouts and staff cards.

Be ready with documentation. Directors and owners will need proof of ID and address. Limited companies typically provide the Companies House registration number and certificate of incorporation. Sole traders should have details of the trading name, business address, and expected turnover. Most providers will ask about the nature of your business and sources of funds to meet anti-money laundering rules. Venues trading late or handling lots of cash may face additional onboarding questions about licensing and cash processes.

Digital providers can approve straightforward applications in hours or days. Traditional banks may take longer for higher-risk or more complex structures. To avoid hold-ups, prepare accurate information about ownership, expected monthly transactions, cash deposit needs, and your licensing position.

Why the right choice matters for bars

Margins in hospitality can be tight, often in the 5-15 percent range. Fee structures can make a noticeable difference to profit, especially for venues with frequent small card transactions and regular cash deposits. Headline free banking offers are helpful, but the real value shows up in ongoing tariffs, deposit charges, and day-to-day usability.

Safety is another priority. Bars may hold significant takings and payroll funds in their current account. FSCS protection at licensed banks provides a hard cap per eligible business per banking group, while non-bank providers safeguard funds in segregated accounts. The risk profile and recovery process differ, so some owners spread balances across providers to manage exposure.

Operationally, the right features can save hours each week. Bulk payroll, staff expense cards, automated categorisation, and clean feeds into your accounting platform reduce admin and accountant costs. If you ever need an overdraft or loan for a refurbishment, a high-street relationship can help - though some fintechs integrate with third-party lenders.

Quick comparison - benefits and drawbacks

| Option | Pros | Cons |

|---|---|---|

| High-street bank business accounts | Branch support, cash deposit facilities, overdrafts and loans, relationship management | Longer onboarding, monthly fees, deposit charges can be higher for cash-heavy bars |

| Digital challenger bank accounts | Fast setup, low or no monthly fees, great apps and integrations, instant alerts | Limited cash services, some eligibility restrictions, lending options may be narrower |

| E-money and fintech accounts | Modern tools, sub-accounts, low-cost international payments, quick approvals | No FSCS protection - safeguarding only, potential payment limits, app-only support |

Watchpoints before you apply

Be clear on how you take payments and how often you bank cash. Many providers tier fees for cash deposits, and charges can ramp up once promotional free-banking periods end. Check electronic payment fees, ATM withdrawal costs, and any charges for CHAPS or international transfers if you import stock.

Confirm protection. If FSCS coverage is essential to you, choose a fully licensed bank and check the latest FSCS limit. If you prefer a fintech for speed and tools, understand how safeguarding works and whether you should split funds. Look closely at eligibility - some app-only providers do not support complex ownership structures or partnerships.

Integration matters. Ensure your account connects cleanly to your POS and accounting software to reduce reconciliation work. Multi-user access, approval workflows, and spend controls are valuable in busy venues where managers handle day-to-day purchases. If you are switching, use the Current Account Switch Service where eligible, but confirm that card acquirers, merchant services, and POS payouts will continue smoothly.

A small tariff difference on cash deposits can outweigh a whole year of headline free banking.

Other routes you could consider

- Keep a high-street account for cash handling and lending, plus a fintech account for day-to-day card settlement and expense cards.

- Use sub-accounts or spaces to ringfence VAT, PAYE, and rent so money for bills is never mixed with operating cash.

- Explore merchant accounts or integrated payment providers that settle directly into your chosen business account.

- Consider specialist hospitality banks or account tiers tailored to venues with late trading and cash needs.

- If declined, try providers known for flexible eligibility or e-money accounts as an interim step while you improve documentation.

Frequently asked questions

Do I legally need a business account for my bar?

If you operate as a limited company or LLP, yes - your company is a separate legal entity. Sole traders are not legally required, but a dedicated account is strongly recommended for clean records and simpler tax.

How safe is my bar’s money?

Licensed UK banks typically offer FSCS protection up to a limit per eligible business per banking group. Some sources reference higher limits - always check the latest figure. E-money providers do not offer FSCS but must safeguard funds in segregated accounts.

What documents will I need to open an account?

Expect proof of ID and address for owners and directors. Limited companies usually provide a Companies House number and incorporation documents. Providers also ask about the business model, licensing, sources of funds, and expected turnover.

Which fees matter most for bars?

Focus on cash deposit charges, electronic payment fees, and monthly account fees after any promotional period. Also check limits, international transfer costs, and fees for extra cards or advanced features.

Can I switch without disrupting service?

Many UK providers support the Current Account Switch Service for eligible business accounts. Plan the switch around payroll and card settlement cycles and check compatibility with your POS, merchant services, and accounting software.

How Switcha can help

Choosing the right setup is easier with clear comparisons tailored to how your bar actually trades. Switcha will connect you with the best options for what you are looking for, highlighting fees, features, eligibility, and switching support. We keep things simple and transparent so you can make a confident, informed choice.

Important information

This guide provides general information, not financial or tax advice. Always check current FSCS limits and provider terms, and speak to a qualified adviser or your accountant about your specific circumstances before making decisions.

Next step: shortlist 2-3 providers that fit your cash handling and software needs, then gather documents to apply the same day.

Get smarter with your money

Join thousands of people in the UK who are taking control of their financial future

FAQs

Common questions about managing your personal finances

Begin by tracking every expense for one month. Use an app or spreadsheet. No judgment. Just observe your spending patterns.

Cancel unused subscriptions. Cook at home. Compare utility providers. Small changes add up quickly.

Aim for 20% of your income. Start smaller if needed. Consistency matters more than the amount.

Choose reputable apps with strong security. Read reviews. Check privacy policies. Protect your financial data.

Pay bills on time. Keep credit card balances low. Check your credit report annually. Be patient.

Still have questions?

Our team is ready to help you navigate your financial journey

More financial insights

Explore our latest articles on personal finance and money management