Master your finances

Smart tips for budgeting, saving, and making your money go further.

Plain-English guide to getting approved for overpayment-friendly UK personal loans, making fee-free extras, and avoiding penalties while cutting interest and time.

How to use overpayments, fee-free options, perks and promo thresholds to cut interest and clear UK personal loans faster. Plain-English tips, steps, and watch-outs for 2025.

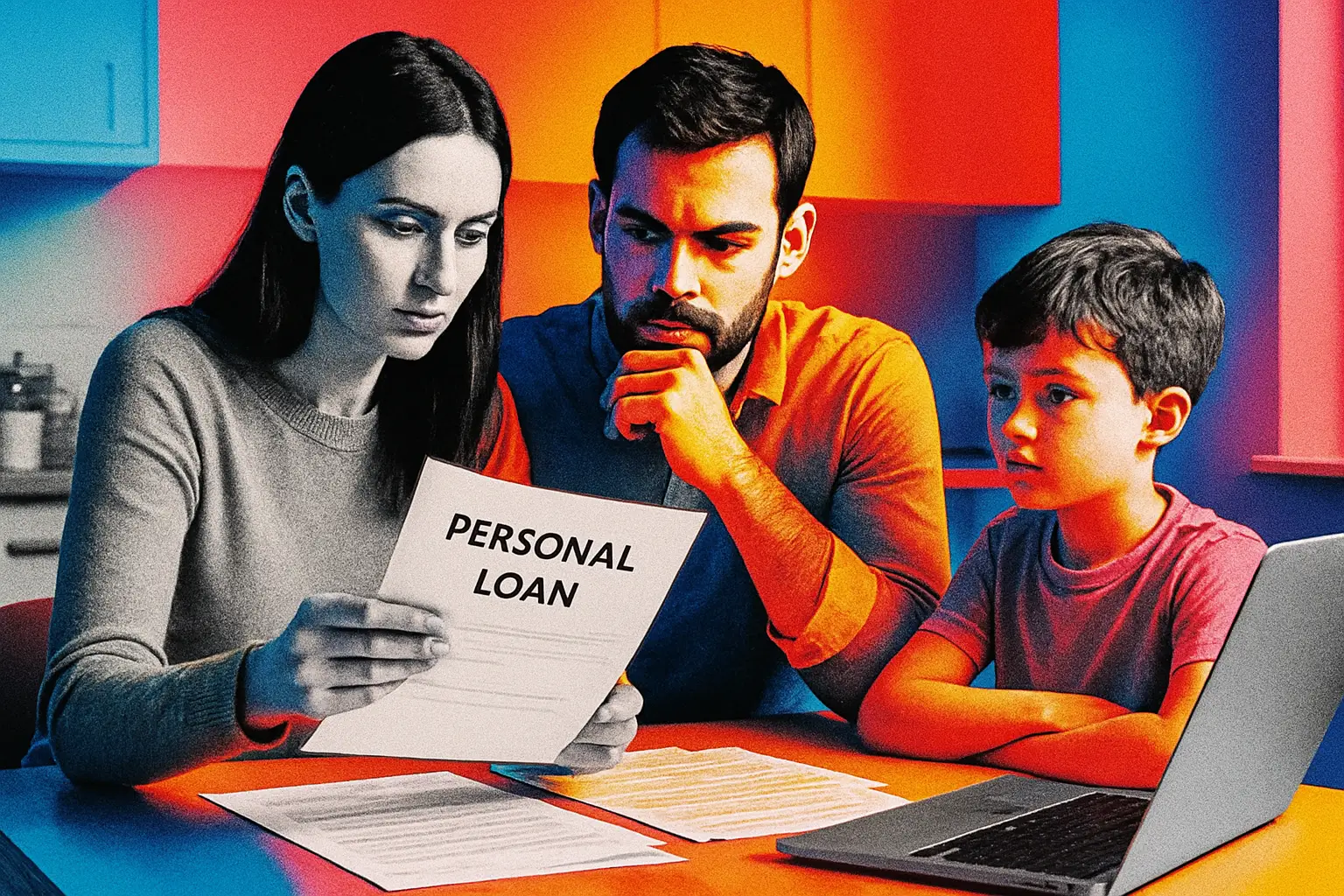

Personal loans can beat cards and overdrafts on cost and clarity. Learn rates, risks, and overpayment perks so you borrow smarter and pay less.

Cut loan costs by overpaying the right way. Learn your UK rights, fees, and simple steps to save interest and finish debts faster with confidence.

A clear, UK-focused guide to overpayment-friendly personal loans, how they work, the rules, costs and steps to save interest and clear debt sooner.

Cut your UK personal loan costs with overpayment-friendly deals, smart terms, and eligibility checks. Plain-English tips and 7 proven ways to save from Switcha.

Learn how overpayment-friendly UK personal loans work, what fees apply, and how to compare lenders to cut interest and clear debt faster without nasty surprises.

No-nonsense guide to fixed-rate personal loans in the UK. Compare costs, eligibility, and pitfalls so you borrow smart, not dear.

Everything UK borrowers need to prepare for a fixed rate personal loan, including income, ID, address, and digital submission tips. Cut delays, improve approval odds, and get funded faster.

What UK borrowers really think of fixed rate personal loans, with ratings, common uses, rates, pros, cons, and smart steps to apply confidently.

Straightforward UK checklist to cut loan costs, avoid credit score knocks, and pick a fair fixed-rate deal. Clear steps, smart comparisons, and practical tools to use before you apply.

A down-to-earth UK guide to fixed rate personal loans, costs, risks, eligibility, and alternatives, so you can borrow smartly without surprises.

A plain-English guide to fixed-rate personal loans in the UK, including costs, risks, and smarter alternatives so you can budget confidently and avoid nasty surprises.

Stay ahead with our newsletter

Get the latest money-saving tips and exclusive deals delivered straight to your inbox